What’s the difference between an accountant and a bookkeeper?

Accountants and bookkeepers can both provide unique insights into how much it costs to start a business and how to create an effective business budget, which will help to improve your chances of survival.

In this article, we’ll explain the key functions and differences between an accountant and a bookkeeper, how to decide if you need one for your small business and which one is best for your specific needs.

Table of contents

- The main function of bookkeeping

- The main function of accounting

- What are the key differences between bookkeeping and accounting?

- Should you get an online accountant or bookkeeper?

- The role of accounting software

- How to decide if you need an accountant or bookkeeper for your business

- Wrapping up

The main function of bookkeeping

A bookkeeper’s primary role is to handle your business’s day to day financial data. A bookkeeper should be able to compile reports that give you a snapshot of where your business stands financially at any given moment.

More specifically, a bookkeeper is responsible for:

- Recording financial transactions. This includes data entry for all receipts, payments, and other financial transactions.

- Posting debits and credits. Recording every single payment that goes out or comes into your accounts.

- Producing invoices. Creating, sending, managing and recording any payments that you are owed or owe.

- Maintaining and balancing subsidiaries, general ledgers, and historical accounts. A general ledger is the primary financial record-keeping system for your business. It holds all of the account information needed to prepare essential financial statements and transaction data segregated by type (i.e. assets, revenues, expenses, liability, etc.).

- Completing payroll. Managing any and all payroll functions if you employ someone or hire freelancers or contractors to help you with business tasks.

Ideally, a bookkeeper will update your books at the end of each and every business day. This way, you always know the true status of your finances at any given time. If you’re just starting out and don’t yet have daily income or expenses, it may make more sense to hire a part-time or freelance bookkeeper to reconcile your funds once a week instead.

The main function of accounting

An accountant’s primary role is to help you make sense of your business’s finances. This includes analysing, summarising, interpreting and producing models and reports.

More specifically, an accountant is responsible for:

- Preparing and adjusting entries. This includes recording expenses that have occurred but aren’t yet recorded in the bookkeeping process.

- Preparation of financial statements. These may include quarterly or year-end documents, budgetary forecast activities, and so on, many of which have deadlines and tax implications that your accountant will ensure are met and complied with.

- Analysing costs of operations. Helping to ensure you stick to your business budget, remain cash flow positive and achieve profitability.

- Completing income tax returns. Complying with any and all government guidelines and standards, filing on time to avoid penalties and providing general tax advice.

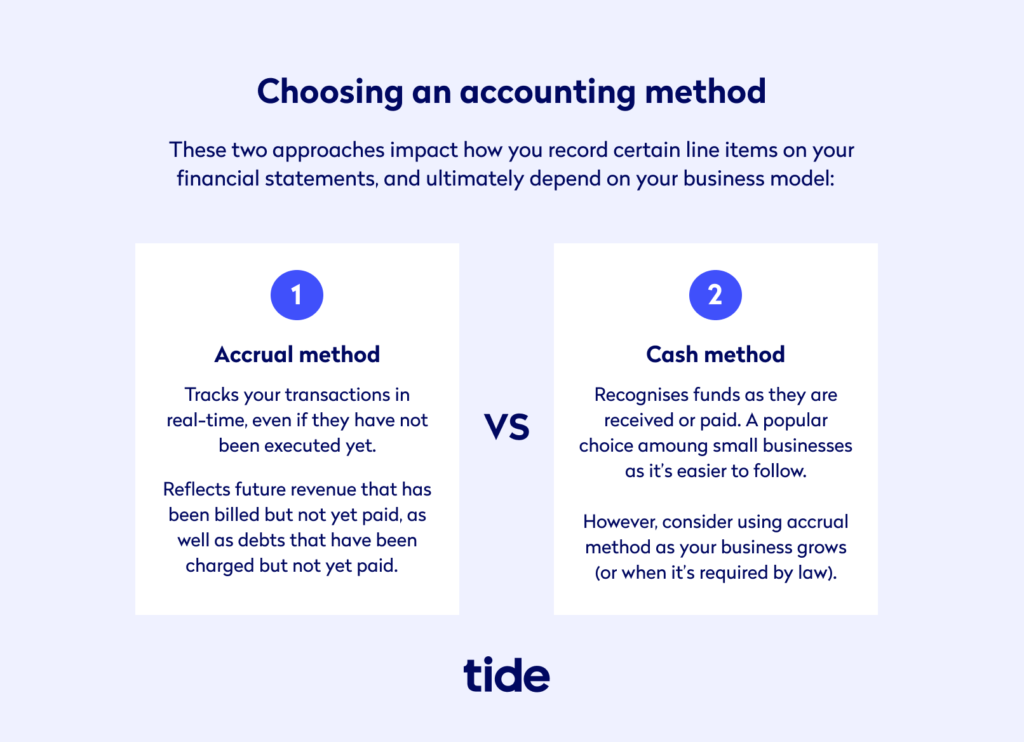

- Aiding the business owner in understanding the impact of financial decisions. From business operations to payroll software, which accounting method to use, accounting process and accounting principles you should adopt, and forecasting revenue trends and revenue expectations, your accountant will guide you on anything related to business spending and earnings and provide helpful and crucial advice for how to achieve your goals.

Ultimately, your accountant will give you financial advice to ensure your financial documents are completed and maintained in a timely and lawful manner and offer strategic financial recommendations based on your company’s financial activities.

What are the key differences between bookkeeping and accounting?

Think of a bookkeeper as a financial compiler and an accountant as a financial translator and consultant.

Where a bookkeeper helps you to record financial information, an accountant both records, analyses and assists you in understanding the impact of your financial decisions. Often, an accountant will oversee the role of a bookkeeper but never the other way around.

That said, the roles may merge depending on your business size. In larger businesses, these roles are often clearly defined and have separate tasks and responsibilities. However, in smaller businesses, and especially new businesses, a bookkeeper may take on some accountancy tasks and vice versa.

This is why it’s so important that you understand and define your needs before you begin your search so that you can hire somebody that is capable of doing exactly what you’re looking for.

What experience is a bookkeeper required to have?

A bookkeeper does not need to have a licence or a bachelor’s degree to get hired or do a great job. However, bookkeepers can choose to become a qualified professional bookkeeper to level-up their career and further validate their skillset.

What experience is an accountant required to have?

As for accountants, they do need a degree and further qualifications to enter the profession.

Accountants can start their journey by completing an Association of Accounting Technicians (AAT) qualification, but this does not mean that they are a chartered accountant. Rather, the AAT qualification is considered the first step into an entry level accountant position.

From there, there are three levels of globally-recognised certifications that accountants can obtain to become a chartered accountant (otherwise known as a certified public accountant or CPA outside of the UK):

- Associate Chartered Accountant (ACA)

- Association of Chartered Certified Accountants (ACCA)

- Chartered Institute of Management Accountants (CIMA)

The main difference between these qualifications is the ability to progress in their career ambitions. For example, larger companies with complicated finances often prefer accountants with more qualifications under their belt. But as a new or emerging small business, an accountant with any of these qualifications may easily suit your needs.

That said, the more advanced their qualification, the more they may grasp incredibly complex topics like tax law, so do keep that in mind.

Should you get an online accountant or bookkeeper?

Online accountants or bookkeeping professionals can also be full time remote employees, freelancers or contractors. This function is especially useful given the COVID-19 pandemic that has forced many people and businesses to work from home remotely.

Accountants and bookkeepers traditionally needed to come to an office to work with paper filings and reports, maintain physical journal entries, complete payroll services and use expensive, in-house software and servers.

While that’s still necessary for some establishments, modern technology has made it possible to do all of these tasks online.

The role of accounting software

Accounting software has replaced the need for big infrastructure when it comes to physical office and server space.

Now, an accountant or bookkeeper can use software subscription services that make it easy to work collaboratively with their clients simply via a laptop and an internet connection. Data is secured in the cloud, which means there’s no need for archive or paper backup filings any longer.

Moreover, accounting software has helped to automate many tasks that a bookkeeper used to complete manually, such as:

- Recording expenses and payments

- Categorising entries

- Creating basic and customised reports

- Managing payroll

- Sending invoices

- Reconciling bank accounts

- Making payments

- Handling expense reimbursements and deductions

Keep in mind that not all accounting software systems are created equal. Some are capable of only the most basic tasks while more advanced ones come with tons of added features. The right one for you depends on your business size and needs.

While bookkeeping tasks such as these can now be automated, that doesn’t necessarily mean that you don’t need a bookkeeper to supplement your accounting software, and it certainly cannot replace an accountant.

You still will need an online accountant to help you to analyse and provide insights into your more complicated reports, such as your balance sheet, statement of cash flows, trial balance, and profit & loss reports.

Further, an online bookkeeper can be crucial in helping you to set up your accounting software. It can be complicated to customise your software to work in the most optimal way for your business and a dedicated bookkeeper and/or accountant can help get it up and running smoothly.

Simple and secure accounting from Tide

With a Tide business bank account, you can easily use our simple and secure accounting tool (Tide Accounting) to categorise your income and expenditure.

What’s more, you’ll handle your biggest bookkeeping and accounting tasks in the same app you use for your banking – with ease and simplicity.

Designed specially for busy small business owners, Tide Accounting software makes it quick and easy to:

- Get paid faster by creating and sending personalised invoices

- Manage your bills better to boost your cash flow

- Track your business performance with brilliant bookkeeping

- Get your Self Assessment and VAT returns right first time

Find out how you can take the stress out of accounting with Tide Accounting.

How to decide if you need an accountant or bookkeeper for your business

Hiring an accountant or bookkeeper can be the extra level of security you need to give you the best possible chance of making it past your first few years of operation.

Plus, managing your business finances takes up your valuable time. If you hire somebody to help you with it, you’ll be able to spend more time running and growing your business, which is ultimately your most critical responsibility.

When it comes to making a hiring decision, start by considering your top priorities. Here are some questions you can ask yourself:

- Are you confident in your ability to create an effective business budget?

- Do you need advice on how to fund your business or how to raise venture capital?

- Do you understand the various company formation types that you can choose from and how each type will affect the way you register your business and file your taxes?

- Are you fully aware of all of the rules surrounding how to pay employees?

- Do you feel confident when using the terms balance sheet, profit and loss statement, cash flow statement and sales forecast?

If the answer to any of the above questions is ‘no’ then at the very least an accountant or a bookkeeper can help you set up your business properly and teach you some of the basics. If you find their presence helpful, keep them on. If you hire them on an interim basis and feel you can proceed without them until you ramp up your business, that’s a perfectly viable option as well.

If you’re just starting out and don’t have many clients, customers or revenue just yet, you may be OK with simple accounting software that you set up and use yourself. But as you begin to grow, keep in mind just how much an accountant or bookkeeper could provide you with the peace of mind you need to thrive.

Can you hire both an accountant and a bookkeeper?

Absolutely, and as you grow, you may well need both. Linearly, you would start by hiring a bookkeeper first and then hiring an accountant when your finances start to become more complicated.

If you do end up hiring both of these roles, it’s critical that they have great communication and work well together. Your accountant will rely on your bookkeeper to keep accurate books so they must seamlessly work together to maintain top levels of financial health for your business.

Wrapping up

The role of a bookkeeper and an accountant are both vital, yet exist for different purposes. That said, as accounting software grows in popularity, the roles are beginning to merge.

Accounting software can automate the tasks that a bookkeeper traditionally did, but that doesn’t mean their role will become redundant. Bookkeepers and especially accountants will always play a vital role in helping you to set up your business finances, whether online or offline.

An accountant needs more experience and qualifications than a bookkeeper because they will help to advise you on how to spend your money as well as the best path for your business’s financial growth. As you grow, you may decide you need both roles to maintain your business finances, and that’s completely normal and expected.

Before you choose to hire a bookkeeper or an accountant, analyse your business needs to determine not only how much, but what kind of financial help you need. Then, register your business with Tide, set up a free business bank account, integrate it with your software of choice and focus on what matters the most: growing your business.

Photo by NAME, published on Unsplash